Soluciones rápidas y de calidad

Somos una empresa que ofrece soluciones personalizadas en el rubro metalúrgico e hidráulico.

Contamos con equipo humano y tecnología avanzada que nos permite adaptarnos rápidamente a las necesidades de los clientes y ayudarlos a ser más productivos.

Ofrecemos servicios como:

- Reparación y fabricación de cilindros hidráulicos

- Fabricación de sellos hidráulicos

- Reparación rotopercutores y martillos hidráulicos

- Reparacion de reductores, mandos finales y transmisiones hidráulicos

- Desarrollo de sustitución de importaciones

- Representantes de:

SERVICIOS

Cilindros Hidráulicos

Sellos Hidráulicos

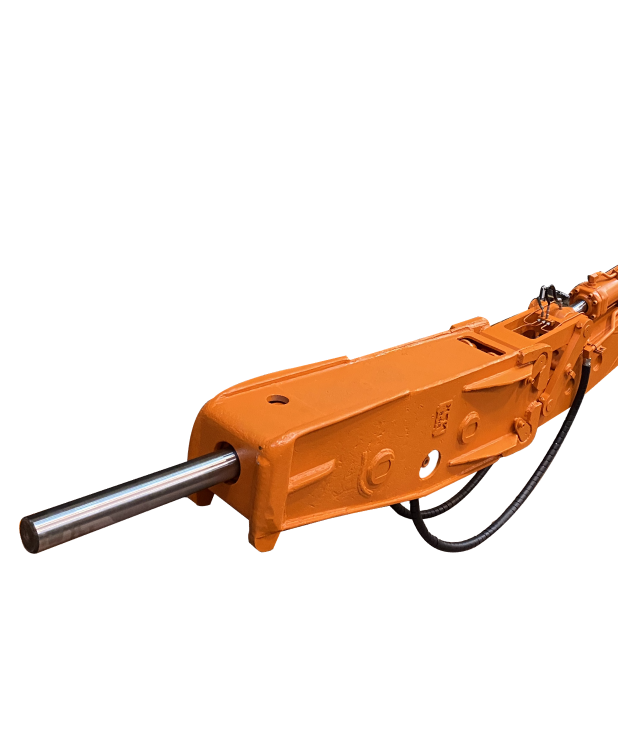

Martillos Hidráulicos y Rotopercutores

Mecanizados Especiales

Mandos finales, transmisiones, masas de freno y Motoreductores

Bujes, rotulas y pernos

Trabajos completados

+15.000

Te ayudamos con:

- Fabricación y reparación de cilindros hidráulicos.

- Modificaciones hidráulicas, eléctricas y neumáticas.

- Detección de fallas y roturas hidráulicas.

- Trabajos mecanizados de piezas especiales según planos.

- Reparación de martillos hidráulicos y rotopercutores.

- Fabricación de empaquetaduras especiales en todos los materiales.

- Servicios de mantenimiento en equipos hidráulicos móviles y fijos.

Nuestro Alcance como empresa

Como empresa líder en el sector metalúrgico, somos tu solución hidráulica completa. Ofrecemos una amplia gama de servicios especializados, incluyendo cilindros, martillos y sellos hidráulicos de primera calidad. ¿Necesitas alto rendimiento, potencia y durabilidad en tus proyectos? ¿Buscas garantizar la estanqueidad y prolongar la vida útil de tus equipos? ¡En CAMSA tenemos la solución perfecta para vos!

Representantes de:

NUESTROS CLIENTES

Nos enorgullece contar con una amplia lista de clientes satisfechos que respaldan la calidad y excelencia de nuestros trabajos realizados. Nuestros socios confían en nosotros para ofrecer soluciones de metalurgia personalizadas y eficientes que cumplen con sus expectativas y superan sus requerimientos.

Nuestro equipo

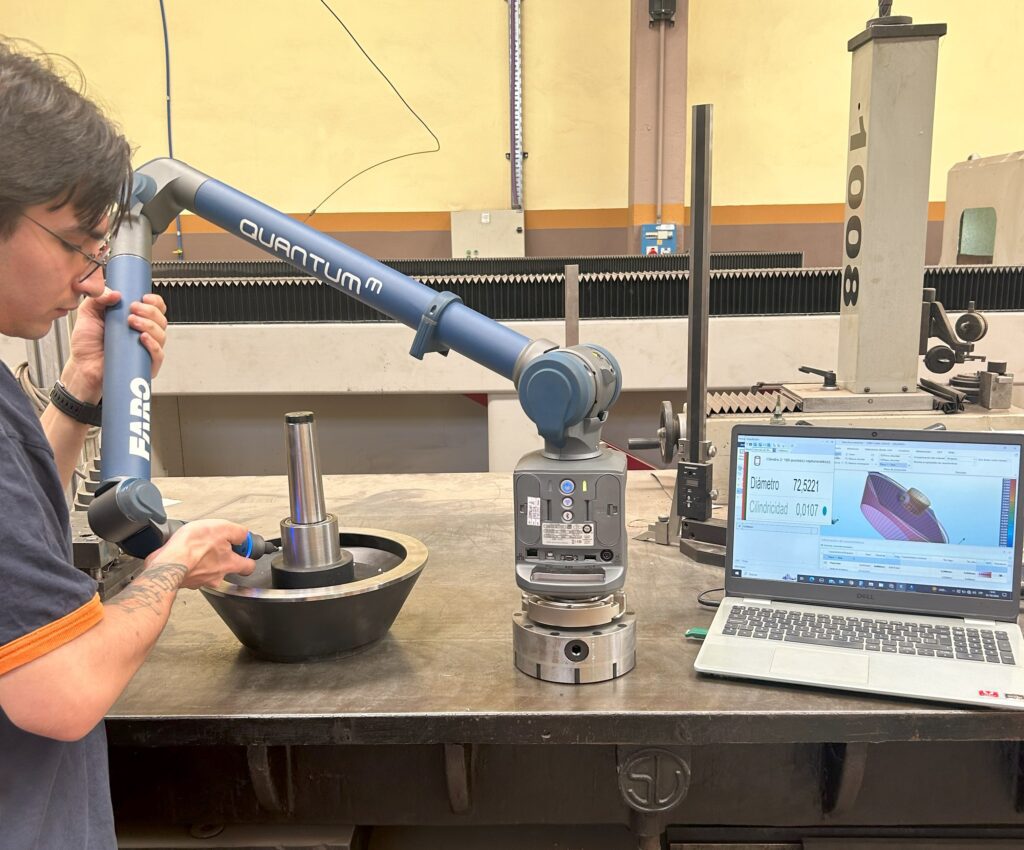

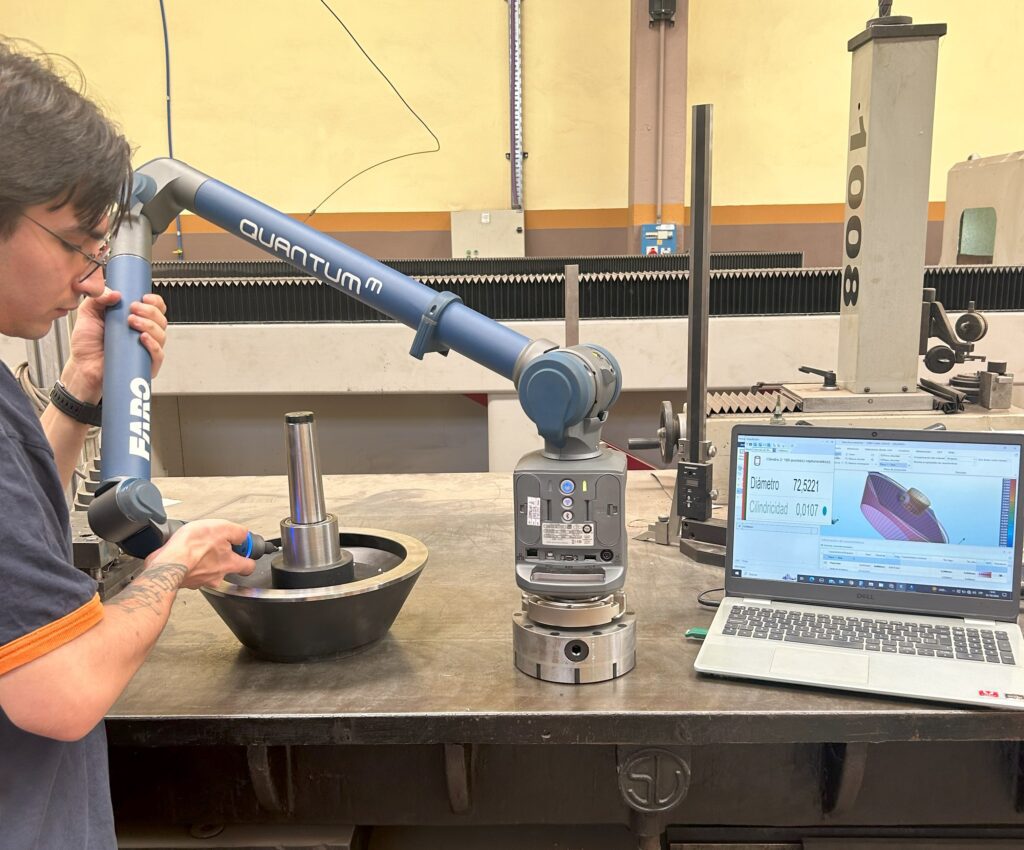

Sumado a la tecnología avanzada y materia prima de calidad contamos con el desarrollo continuo de nuestro equipo humano que nos permite adaptarnos a tus necesidades de forma inmediata y personalizada.

Nuestra misión es brindar una solución integral y eficaz.

MAQUINAS Y HERRAMIENTAS

Contamos con máquinas, herramientas e insumos de última tecnología que nos permiten entregar trabajos de calidad, probados y con la respectiva entrega de informes.

Brazo faro de medición

Torno convencional 2000 mm voltéo 8000 mm de largo